This has not been a good month for our 17 year old son’s vehicle. We purchased a 2002 Chevy Trailblazer a couple years ago and it has been a good first car for him. He’s experienced a couple of minor mishaps in it, but it has proven to be safe and reli…., well not so…

Lesson 007: You Need A System

Choice is good, right? Like most questions in life, the answer is “it depends”. Having choice is usually seen as a positive thing. It allows us to exercise free will. We like to associate it with FREEDOM! But having too many options to choose from can be counterproductive and can prevent you from making forward…

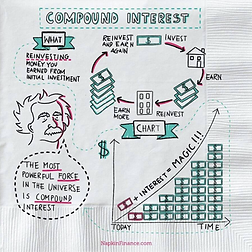

Why Your Teenager Should Be Thinking About Retirement

Teens don’t typically think long-term strategies. That’s not surprising. They have only been alive for less than 20 years (hence the term teenager), so thinking 40 or 50 years into the future is sometimes too abstract. But if they only knew how much their future selves would benefit from a little education and effort, maybe…

LESSON 006: Get Started TODAY

“If I had only been taught this stuff when I was young.” I hear it often. We use the ignorance of the past to serve as our excuse for inaction today. As a young adult just entering the workforce, you likely thought the idea of retirement some 40+ years into the future was too distant…

Mortgage Refinance

We are refinancing our home mortgage. Interest rates are still extremely low and our rate will only be dropping from 4.5% to 3.625%. Some might argue that this isn’t enough of a reduction to warrant the time, effort, and cost of refinancing. I disagree. We will likely pay for most of the fees associated with…

LESSON 005: There’s No Such Thing As Willpower

People talk about willpower as if it is some supernatural power. A force that requires Jedi-like mastery that can be used to alter the fabric of space-time in order to prevent cookies from entering your mouth. But there isn’t a supernatural power or magic involved, nor is there willpower. There simply are your choices. And…

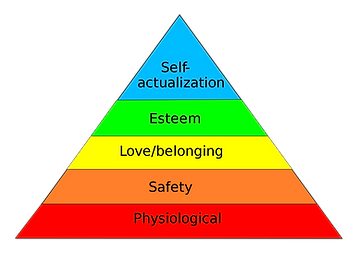

LESSON 004: Needs vs. Wants

In 1943, Abraham Maslow introduced us to his hierarch of needs concept. The basic premise is that needs must be satisfied from the bottom up. For example, if one’s physiological and safety needs are not met, love and belonging, esteem, and self-actualization cannot be fully realized. Physiological needs – food, shelter, sleep, homeostasis Safety needs…

Living ‘like’ a millionaire

A popular expression I used to hear a lot when I was in the service was “you’re never going to get rich working for the government”. I’m sure other work sectors share the same sentiment. But just saying it, even believing it, doesn’t make it true. A good paying job along with the ability to…

LESSON 003: Mind the Gap

According to Vicki Robin, author of Your Money or Your Life, U.S. respondents to happiness surveys consistently rate their happiness between 2.6 – 2.8 (out of 5) regardless of income level. When asked how much more they’d need to be happy, they respond somewhere between 50-100% more than they have now. But those that have…

Could You Be Happy Earning $500,000 per Year?

The New York couple in this CNBC article feels stress about their finances and “average” lifestyle, despite a household earning of $500,000 per year. Living in New York is certainly more expensive than in many other parts of the country, but does their financial stress stem from their circumstances or their choices? In Vicki Robin’s…